Let’s be real: getting your home loan rejected hurts.

You’ve gathered documents, filled out forms, maybe even picked out a dream house—only to be met with a big, fat “DECLINED.” 😩

The truth? Banks have strict (and sometimes silent) rules when it comes to approving loans. But knowing why rejections happen can help you avoid them—and that’s where Matchmo comes in.

Let’s break down the most common reasons why banks say no—and how to turn that “no” into a big green light.

1. Low or Unstable Income

Banks want to make sure you can pay back your loan consistently.

If your income is too low or unstable, your application might get flagged.

How Matchmo helps:

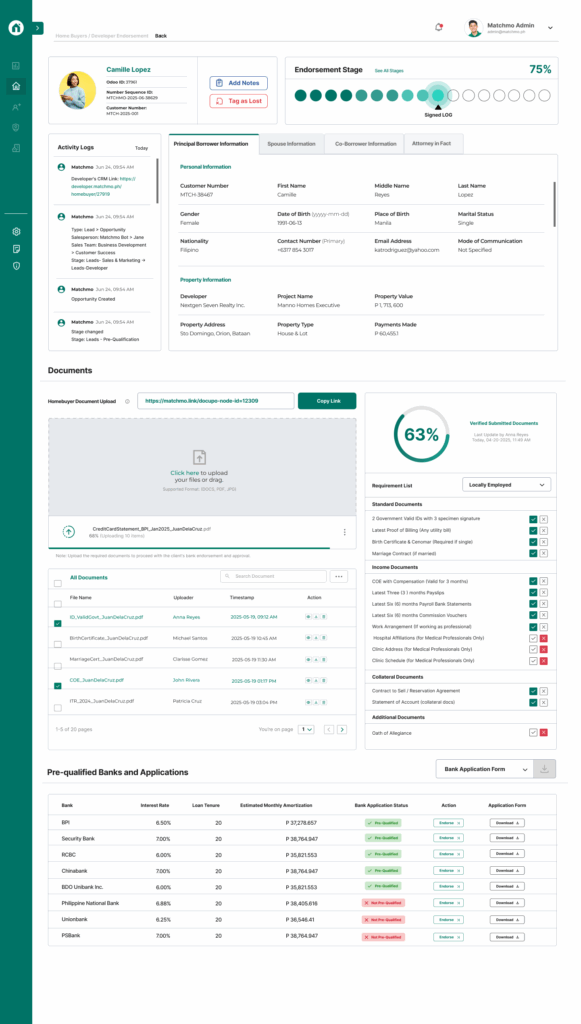

We pre-qualify you based on your real income streams and recommend banks that fit your income type.

2. Poor Credit History or Existing Debts

If you’ve ever defaulted on a loan, missed credit card payments, or maxed out your limits—banks will know.

Credit history is one of the top reasons for rejection.

Matchmo Tip:

Be transparent. We’ll help position your application honestly and smartly—some banks are more lenient than others.

3. Incomplete or Incorrect Documents

A missing payslip or a wrong spelling on your COE can delay—or kill—your application altogether.

With Matchmo, our team helps you compile and check all your files before endorsement. We reduce human error so you’re bank-ready, faster.

4. Property Issues

Even if you’re qualified, the property itself can be a problem. Some banks won’t finance homes with incomplete titles, unclear land classification, or those from non-accredited developers.

Our edge:

We only endorse you to banks that accept the property you’re buying.

5. Age or Employment Status

Too young? Too close to retirement? Freelance with no official contract? Banks have preferences when it comes to who they lend to.

Matchmo Hack:

We help you find banks with more flexible criteria and guide you on how to present your employment proof—even if you’re self-employed or on project-based work.

Loan rejection isn’t the end—it’s just a signal to apply smarter.

💡 At Matchmo, we don’t just guess where you might qualify. We match you to the banks that fit your income, lifestyle, and property—without wasting your time.

👉 Avoid the “DECLINED” stamp. Try Matchmo’s free pre-qualification and apply with confidence.

![[TEST BLOG AUG] Top Reasons Why Banks Reject Home Loan Applications in the Philippines](/_next/image?url=%2Fapi%2Fwp%2Fwp-content%2Fuploads%2F2025%2F08%2FHomebuyer-Broker-Endorsement-3-581x1024.png&w=3840&q=100)